Predatory financing may grab the brand of auto loans, sub-perfect fund, house guarantee funds, tax reimburse anticipation fund or any consumer debtmon predatory lending means include a failure to disclose suggestions, exposing not the case pointers, risk-situated costs, and you will inflated charge and charges. These types of practices, possibly truly or when joint, do a routine regarding obligations that triggers significant pecuniary hardship to have family and folks.

You may have possibilities

While facing loans issues, you could believe this type of loan providers are their just solution. Not true-you’ve got loads of possibilities to help you taking out a high-costs loan:

- Payment plan which have financial institutions-The best replacement for payday loans would be to package individually having the debt. Exercise an extended commission plan together with your loan providers could possibly get enable it to be you to definitely pay your delinquent bills more a longer time of your time.

- Improve out of your manager-Your boss can grant your a salary improve in a crisis condition. Since this is a real get better and never financing, there will be no appeal.

- Borrowing from the bank connection mortgage-Borrowing from the bank unions generally promote affordable short quick-identity loans to help you participants. Instead of cash advance, these types of loans make you a real opportunity to pay having expanded pay periods, down rates of interest, and you will installments.

- Consumer credit guidance-There are various credit counseling companies throughout the You that can help you work-out a personal debt cost package having creditors and produce a budget. These services are available in the little or no prices. The brand new National Basis to possess Borrowing Guidance (nfcc.org) was a beneficial nonprofit providers that will help see an established formal consumer credit counselor close by.

- Emergency Guidance Software-Of a lot people teams and you can believe-dependent communities provide emergency guidelines, sometimes really or using personal services apps for weather-related emergencies.

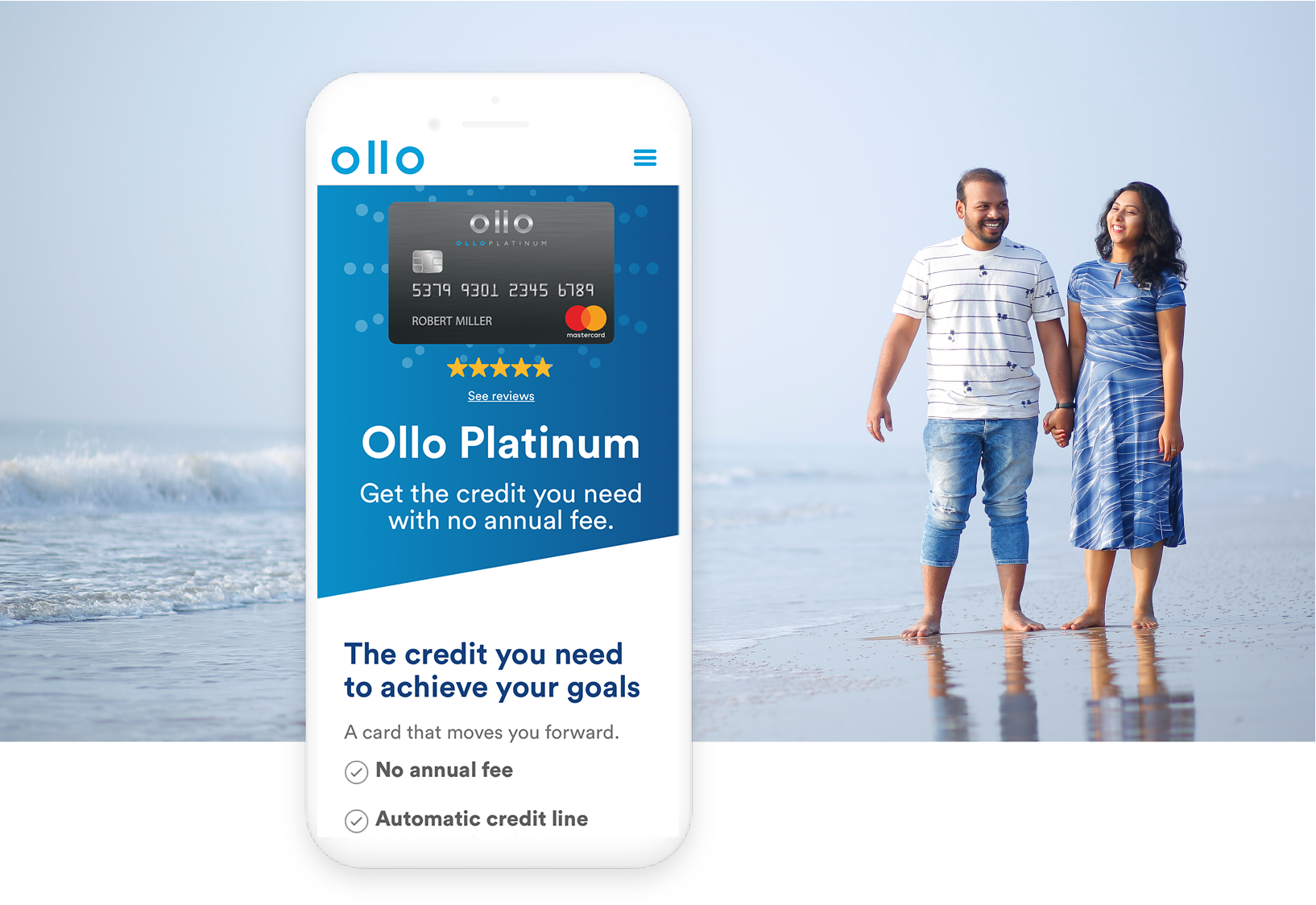

- Payday loan on your own mastercard-Mastercard payday loans, which can be usually offered by an apr (APR) from 30% otherwise reduced, are much less expensive than delivering a quick payday loan. Specific credit card companies specialize in consumers having financial problems otherwise bad credit records. You ought to comparison shop, plus don’t believe that you do not qualify for a credit credit

Sooner, you should know you are responsible, even although you become into the financial hardships. There are numerous solutions to get rid of large-cost borrowing out-of predatory lenders. Take the time to explore your options.

Most of the lenders must review your details ahead of approving that loan

Was this post helpful? Check out all of our It is A financing Thing website to get more small video clips and beneficial articles to help you add up of money, you to definitely situation simultaneously! Have a look at straight back, the latest subjects would-be produced on a regular basis.

Run down and you will empty domiciles ? new inescapable outcome of predatory lending ? wreak havoc on communities. Assets beliefs fall. Someone flow out. Just after sturdy neighborhoods beginning to crack, following crumble. Something could have been essential to have so many people lies within the spoils. Individuals which lived-in a region destroyed by the predatory credit becomes a victim.

Aggressive solicitations. Performed someone sell to you personally? Keep clear away from anybody who involved your trying to sell you a loan. If you need that loan, research rates because of it oneself.

Balloon Payments – A common predatory routine will be to provide a great bower that loan that have lower monthly obligations with a large payment due at the stop of your own loan name. Essentially, an excellent balloon fee is over twice the brand new loan’s North Dakota small personal loans average payment, and frequently it can be tens of thousands of cash. Many times this type of balloon repayments are hidden on offer and regularly hook individuals of the shock.

If you are given a loan with the vow beforehand your guaranteed to feel acknowledged, feel very careful. When you find yourself offered a loan no downpayment, ensure you see the terms of the borrowed funds together with whether you will have an initial loan an additional mortgage having other prices while you may be necessary to pay money for mortgage insurance policies?

Because the predatory funds are usually secured finance, the lender has actually one thing to acquire should your borrower defaults. So, by the tricking a guy to your taking out that loan to own an effective household they can’t pay for, a loan provider are certain to get payments having an occasion and you can following get the possessions straight back during the foreclosures market it for money.

- Mortgage sharks try someone or organizations just who provide funds on extremely highest interest levels. The definition of usually identifies unlawful hobby, but could along with relate to predatory lending pursuits like pay check or identity fund. Loan whales sometimes impose repayment of the blackmail or threats out-of assault.