A property Guarantee Mortgage, sometimes referred to as an excellent HELOC, was an ever more popular solution to access the newest guarantee for the your house. In this article, we’re going to speak about the essential difference between a house Guarantee Financing and you may property Collateral Line of credit (HELOC). Way more especially, we are going to answer fully the question, what’s a good HELOC or property Security Mortgage and certainly will they help me get free from debt and prevent Personal bankruptcy?

Furthermore, we will discuss the benefits and you can drawbacks for every single equipment and you may suggest the need to see the objective or must fool around with possibly.

What is good HELOC?

HELOC means and this signifies Household Collateral Distinctive line of Borrowing (HELOC). Its a personal debt appliance, that is a secured credit line, offered to help you an individual having a protected costs joined toward identity of your own homeowner’s property.

It operates very much the same so you’re able to a credit card. That’s, youre granted a credit limit in which you can be draw upon and make use of for your sort of need and reduce on the line from borrowing from the bank you like. New HELOC necessitates that appeal simply be paid down installment loan Montana on time and when due each month. In the place of an unsecured credit card, an excellent HELOC is actually secured debt, inserted up against the individual’s domestic.

What exactly is a property Equity Financing?

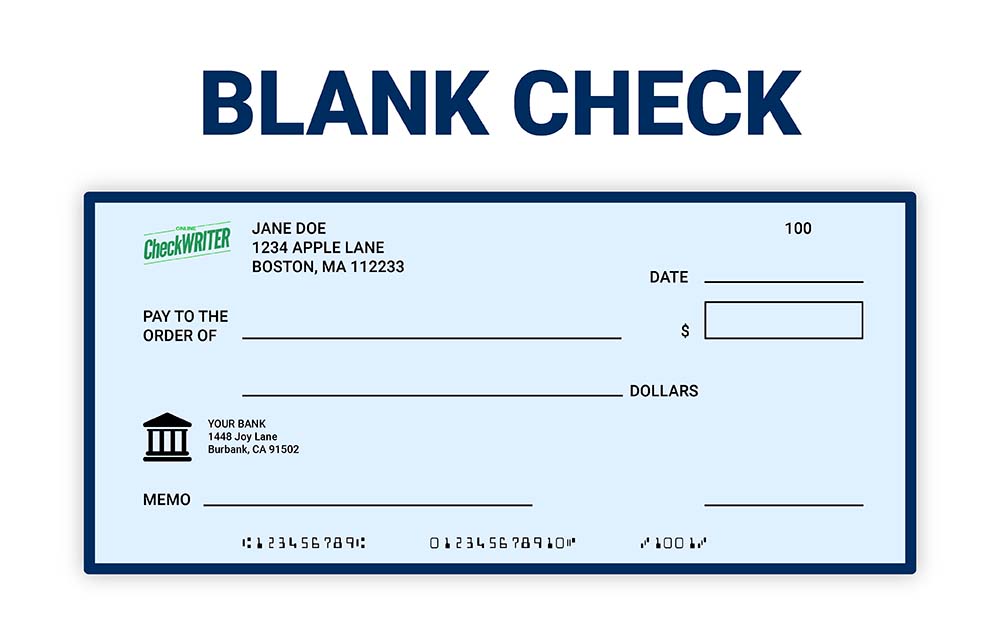

A property Equity Mortgage are a loan, perhaps not a credit line, that is registered resistant to the assets. Our home Security mortgage is additionally also known as an extra home loan entered into the assets. The mortgage was supplied because of the lender having a concurred place count and people finance complex completely that’s, might give you a good draft or cheque for fund borrowed. The fresh new borrower are able to utilize the finance while they need. It is like performing good remortgage should your current financial is expiring.

Discover terms and conditions, both for good HELOC and you may Household Equity Loan, which might be decided at that time the borrowed funds contract try carried out.

- Certification of your own loan was to start with determined by the latest security into the your house also on your own a career background, earnings, and you will credit score. The lender will normally simply progress as much as 75% in order to 80% of value of the home. That is the appraised property value our home shorter the borrowed funds due.

- Interest-simply payments should be made into the a good HELOC and you can paid monthly whereas and notice and you may prominent money on Domestic Equity Financing need to be paid month-to-month;

- Most of the payments should be on time;

- If the borrower default towards their payment per month, subject to the brand new regards to the borrowed funds, the lending company will get consult the mortgage in full pursuant into the mortgage bargain signed within onset. You’ll find tend to grace episodes, although borrower must always keep in touch with the financial institution about their disease and you can remember that forgotten a payment can affect the interest speed becoming billed.

- For the a property Equity Mortgage, discover generally an effective prepayment penalty, therefore you want otherwise propose to retire the debt early you will understand the brand new penalty prior to signing this new bargain and you can borrowing money.

- Inside the a HELOC, there is essentially zero prepayment punishment if you wish to retire your debt very early;

- In, a home Guarantee Loan and you can an effective HELOC, susceptible to the regards to the bargain, if the debtor default to their commission financial obligation towards the bank, the lending company can get upload a notice from Standard while making consult into the full harmony. The lender can then begin foreclosure process or sue.