Mortgage refinancing: ‘s the replacement for out of a preexisting obligations obligation which have another obligations responsibility significantly less than various other conditions. Loan refinancing is performed a variety of factors also to obtain a good ideal interest rate, consolidate obligations, get rid of payment number, etcetera.

To participate, you must be qualified with respect to the borrowing union’s field of registration legislation and come up with the very least deposit

Financing sharks are usurers whom efforts privately, instead of government control, so people that borrow from them have little or no user coverage.

Market capitalization: The full property value an effective business’s outstanding shares out-of stock, people the business has and shares investors individual. Sector capitalization would be titled invested investment. To obtain an excellent organization’s markets capitalization, multiply how many offers the firm keeps given from the price for every express.

Medicaid: A combined state and federal government system that will pay for scientific take care of certain people that can not afford it.

Medicare: The fresh government government’s health insurance, and that will pay for specific healthcare costs for all those age 65 otherwise elderly and some disabled customers. The fresh Societal Protection Administration handles Medicare.

Medicare tax: The latest tax you to definitely money the newest Societal Protection Administration’s health insurance, hence pays for certain fitness-care and attention costs for people years 65 and you can elderly as well as some disabled customers.

Member: Someone who falls under a card commitment. Just after a part, you are a part holder, that have equal voting rights inside the elections towards the credit union’s shareholders, exactly who own offers regarding the financial.

Loan-shark: Someone who lends anybody currency and fees an extremely high interest rate on the loan

Minimum-wage: Minimum of amount a manager can pay affected gurus, with respect to the national law referred to as Reasonable Work Standards Work. Specific claims keeps various other minimum wage requirements.

Mint: An authorities “factory” in making gold coins. Score details about the newest U.S. mint inside the Denver and towards Philadelphia perfect.

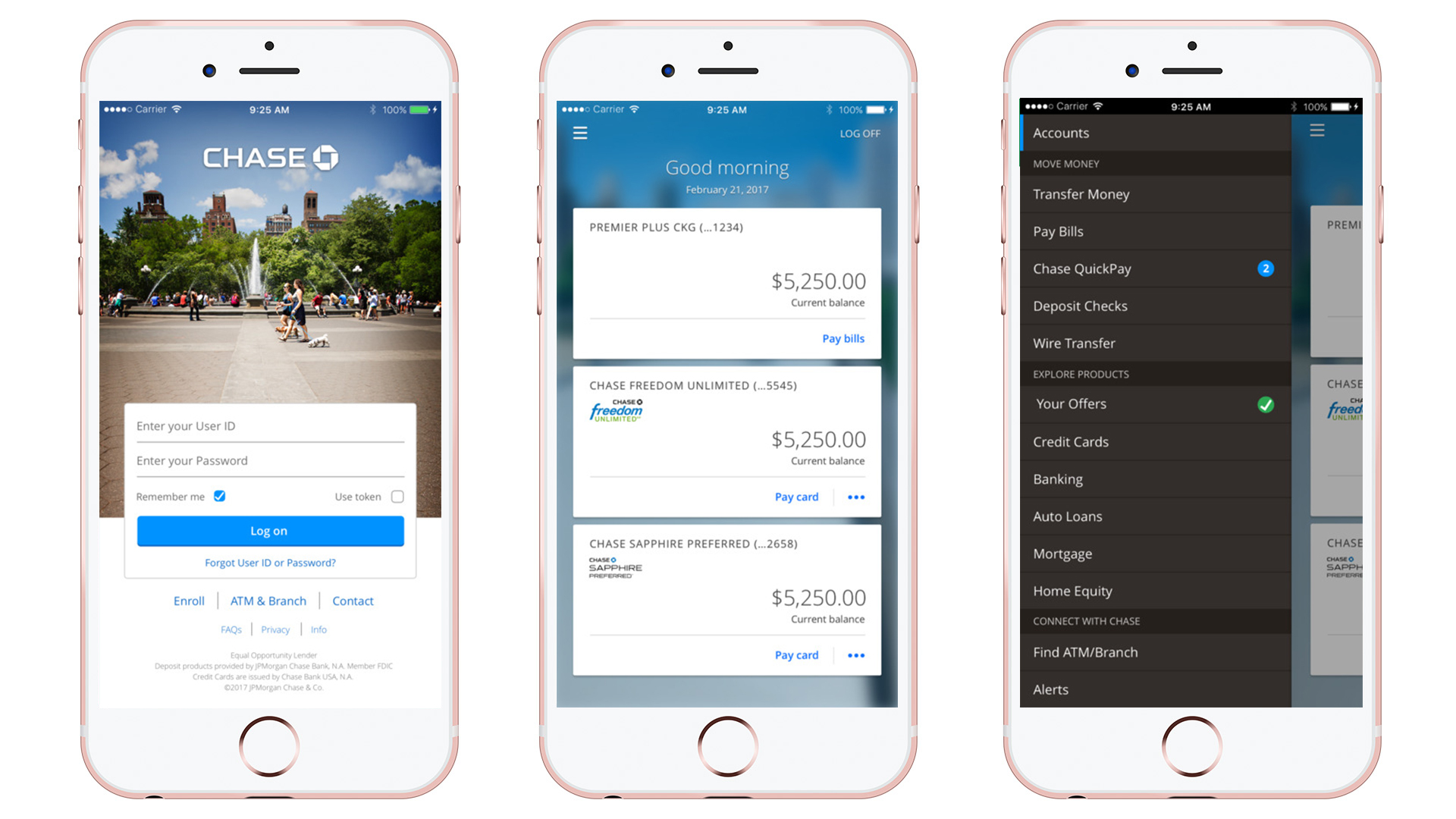

Mobile financial: Mobile banking can be used to have performing equilibrium checks, account deals, repayments, borrowing programs, and other monetary transactions owing to a mobile device eg an effective cellular phone or tablet.

Money sector: The computer for selecting and you may promoting financial obligation tool otherwise ties which have regards to less than annually, and frequently below thirty days. Money industry T-expense, or other brief-title vehicle.

Currency business account: A separate types of savings account you to pays higher rates however, need high lowest balances that can cover what number of month-to-month purchases.

Currency order: A legal document that is a guarantee to pay the person otherwise business titled involved a specified sum of money when exhibited at a loan company. Money instructions try an alternative to paying from the digital fund transfer (EFT).

Mortgage-backed coverage (MBS): A trader can buy offers inside an enthusiastic MBS. The fresh new mortgages must feel from a third party, controlled financial institution and ought online personal loans CT to provides large fico scores.

Mutual funds: A financial investment one a buddies makes on the part of shareholders. The company sells offers about funds and you will spends the cash inside the a small grouping of assets, usually bonds. The newest fund’s executives generate money conclusion considering stated expectations.

Mutual offers bank: A financial whose depositors have it. Regardless of if a cards union’s players individual the financing relationship, the two establishments disagree in many ways. He has got other charters and are susceptible to the fresh controls out of more authorities teams. In addition, new board from administrators of a mutual savings financial try repaid (compared with a cards union’s voluntary administrators) while the owners of a shared discounts lender keeps voting liberties compared on sum of money towards put (compared with the one-member-one-choose habit of very borrowing from the bank unions).