Have you been eager to get your fantasy house this season? Your decision to purchase your new house is quite high. So, as you do the dive toward entering your property-to invest in journey, this post simplifies the condition. Let us gauge the popular styles and you can forecasts created for the fresh new housing marketplace for the 2024. Therefore, are you ready knowing next? Let’s take a look at activities less than.

Annually-End Review & 2024 Predictions

Not everyone is blessed with sufficient deals to invest in property. Rather, spending all of your current offered money in one capital (eg a property) is a mistake. You should build agreements for your future. Such scenarios, our home loan 2024 try a blessing for the disguise.

A mortgage was a practical treatment for safety the total amount you’ll need for to buy a condo. Permits individuals continue the price of the house more lengthy physique. In addition, it allows homeownership in the place of surprise need for a significant initial rates.

Very, since the 2024 has started, the new switching regions of lenders hint at a couple of things. Therefore, you need to understand the brand new property mortgage speed predictions prior to purchasing your dream house. Be sure understand your house mortgage styles and you can predictions of your own current possessions field. Very, why don’t we find the ideal financial fashion when you look at the 2024 in the offered circumstances.

Knowledge Mortgage Fashion to search for inside 2024

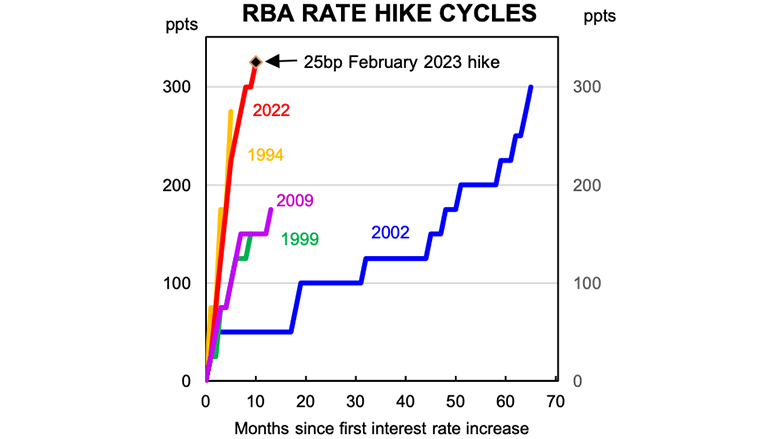

To have houses loan consumers, 2022-2023 was many years in which it watched the fresh new EMI cost heading up. Property mortgage EMIs have raised by more 20% on these many years. However, 2024 shows up that have the new predictions. Depending on housing rates of interest today, the interest rate is anticipated to attenuate from the 0.5% to 1.25%. Existing home loan consumers could possibly get gain far more on the losing .

Which have RBI going for the newest a number of repo rate hikes from , every lenders already been increasing the rates. Nevertheless, rising cost of living together with cooled off, also it conveyed a significant go up. This is exactly why the RBI is anticipated to start reducing the repo rates when you look at the 2024’s next quarter (June or July).

Faster retail rising cost of living can also help RBI to attenuate the repo prices. However, masters believe they could perhaps Northport AL pay day loans not stand limited by one slashed because decreases start. The new possible reduction in the RBI repo rates 2024 try altogether a controversial concept.

Increase out of Digital Loan providers

This year, digital lenders can do the fresh rounds from the helping you change regarding off-line software to online techniques. The fresh automatic process they followed simplifies the job altogether. It can make they smoother for consumers in order to browse the modern credit processes rather than manual work.

The latest Mortgage Fashion

Second comes the borrowed funds brokers, that will revolutionise new recent home loan business. 2022 provides seen an impressive portion of new house funds delivering facilitated of the agents. Your house mortgage prices flower rapidly just last year, with an increase of Indians reconsidering funding. The pattern is just about to change this current year.

The fresh new Advent of Environmentally-Friendly Places

Environmentally friendly or green living space is during popular such weeks. The brand new Indian home candidates have begun counting on the thought of neat and live green. Therefore, home builders have previously been developing buildings that include the absolute minimum ecological impact.

Progressive house apply eco-friendly building processes, environmentally mindful product, and energy-effective equipment. Which trend is about to become more prominent this season.

The necessity for Affordability

Reasonable homes are very an interest among millennial family candidates. This type of homes had been preferred from inside the 2023. And 2024 is going to select a processed type of which layout. The fresh new rising people into the Indian urban metropolises produces affordability the major matter.