Which antique mortgage choice maintains stable rates of interest and monthly payments along the complete life of the mortgage, no matter what people action into the markets list. Veridian also provides fixed-speed financing terms of 10, fifteen, 20, twenty five, and you can 29-years, regardless of if a longer installment months generally speaking causes large costs.

Qualified very first-go out homebuyers normally lay only step three percent upon that it lender’s 15- and you will 31-season mortgage circumstances, though some constraints apply.

Adjustable-Speed Loans

These types of finance are based on variable interest rates, and therefore payment amounts may differ according to sector requirements. Costs can get boost otherwise drop-off throughout the years, even if Veridian has an annual cover from dos per cent and you can a life cap out-of six percent to your every price adjustments.

Individuals can select from a primary repaired-speed creating ages of four, 7, otherwise 10 years, regardless if lengthened episodes can result in large prices. Complete, adjustable-rates mortgages ability all the way down interest levels than other loan products, so it’s a very good selection for homebuyers that have comfy profits otherwise individuals who intend to flow ahead of its cost beginning to to switch.

IFA Funds

This type of mortgage loans is supported by the new Iowa Loans Authority and gives low-costs label safety to possess orders up to $five-hundred,000. The newest IFA also provides a few mortgage software, one another with 30-year fixed-price terminology. New FirstHome System is present so you’re able to very first-day homebuyers who would like to get a first quarters inside the Iowa.

New Homes to own Iowans Program is present of the each other earliest-time and recite homebuyers which qualify, regardless if qualification assistance is rigorous. IFA’s mortgage software enjoys income limitations, and buy rates constraints and you can borrowers should have the absolute minimum borrowing score of 640 and you online payday loan can a max personal debt-to-money proportion away from forty five percent.

USDA Loans

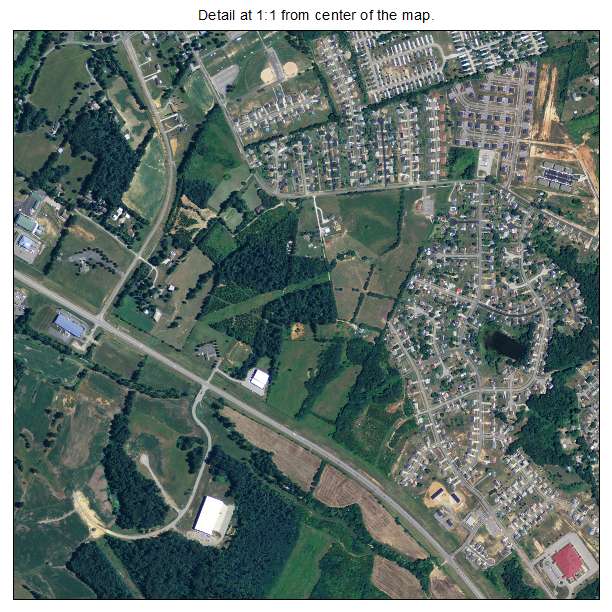

Which mortgage choice is facilitated of the You Institution regarding Agriculture and you will extends 100 per cent capital choices to certified consumers. Homebuyers which have reduced to reasonable money are advised to use, but the possessions concerned must be located in a designated rural urban area.

Eligible individuals with fico scores over 640 can benefit off no deposit criteria and you may affordable interest rates. Earnings constraints for those kind of financing, yet not, was rigorous.

Virtual assistant Fund

Accredited experts and you may service users may benefit using this mortgage types of, because it has zero down-payment minimums and does not want personal mortgage insurance policies. Supported by brand new Service out-of Veterans Things, these types of mortgage brokers give eligible borrowers with reasonable rates and you can a range of investment solutions, even if the very least credit rating out-of 620 is typically required.

Government-backed finance tend to have straight down rates than antique mortgages, and faster closing costs. Which financing type plus allows owner to blow as much as cuatro % of your price on the closing costs, however, present financing are not welcome.

Jumbo Fund

Veridian will bring jumbo financing on mortgage loans that go beyond $726,200, though the antique conforming restrictions are generally set of the Government Casing Finance Agency (FHFA). The latest agencies has just revealed your 2024 limit compliant mortgage restriction for just one-tool attributes would be $766,550.

Eligible homebuyers can acquire either a predetermined or adjustable-price jumbo financial, even when certain factual statements about credit rating and deposit standards is actually unavailable with the borrowing from the bank union’s web site.

Veridian Home loan Customer service

Veridian Borrowing from the bank Partnership mostly operates in the Iowa, which have registration open to people located in otherwise helping an effective business inside the state’s 99 counties; moreover it attributes a few communities when you look at the Nebraska, and Cass, Douglas, Lancaster, Sarpy, Saunders, and you can Washington areas. People can be continue the advantages to people loved one, it is therefore possible for Iowa owners to utilize which borrowing connection.