I has just were rejected to own a great HELOC by all of our local bank (Florida) therefore the entire process is a little perplexing

To help you pertain AI, you need your state-of-the-artwork platform, Bray told experts toward Wednesday. We accepted this new cloud far prior to when the co-workers. Actually, we situated the servicing program to get affect-native right away.

Mr. Cooper and Sagent signed a multiyear agreement during the . Mr. Cooper ended up selling particular rational property legal rights for the cloud-mainly based tech system to help you Sagent and you may gotten a fraction security stake on fintech team.

For each the latest regards to the newest deal, Sagent try assigned with partnering Mr. Cooper’s consumer-very first platform towards a cloud-local key, upcoming certification the resulting affect-mainly based system in order to banking companies and you may separate financial organizations.

Bray along with https://paydayloanalabama.com/vernon/ reintroduced Pyro, Mr. Cooper’s complex home loan-centric AI platform the organization might have been developing due to the fact 2019 in partnership with Google. The working platform harnesses the efficacy of machine reading and you will Yahoo Cloud File AI potential to spot and sort thousands of extremely important records.

By the selecting the right mate to possess affect and you can tech, we had been capable reallocate resources to other strategically important plans, also building proprietary units to own consumer preservation, loan modification and you can onboarding profiles, Bray told you. We’ve got and additionally assigned tips to advance digitize our techniques during the origination and you will servicing.

Mr. nine mil when you look at the unpaid prominent equilibrium (UPB). Which integrated $step one.4 million in direct-to-user originations and you will $step one.5 million in correspondent volume. On an effective quarterly base, financed volume increased 8%, when you’re remove-because of adjusted volume increased sixteen% to help you $step 3 million. Overall originations produced a functional income of $32 million.

At the same time, their repair portfolio finished this new one-fourth at $step one.136 trillion, with UPB off $631 billion during the possessed home loan maintenance liberties (MSRs) and you can $505 billion during the subservicing. Servicing generated pretax doing work income, leaving out almost every other .

It ecosystem was to relax and play on strengths in our healthy business model, even as we try seeing good energy with subservicing members and watching attractive chances to to get MSRs, whenever you are the originations cluster has been most agile in helping customers spend less and you can availability new security they will have built up inside their land, Mr. Cooper President Mike Weinbach told you when you look at the an announcement.

To the Saturday, Mr. Cooper Category entitled former Wells Fargo Household Lending government Ranjit Bhattacharjee and you will former Piper Sandler analyst Kevin Barker to its leadership party.

Bhattacharjee tend to technically subscribe Mr. Cooper on may 6 as its executive vp and you will chief funding manager. He’s going to be the cause of oversight regarding money markets and you will correspondent credit, revealing directly to president and Ceo Jay Bray. Barker’s hiring on the role regarding elderly vp away from corporate financing is effective instantaneously.

You will find mediocre so you’re able to below average credit scores, highest DTI proportion, and about $300k in home guarantee

Mr. Cooper Classification and gotten Home Part Capital and you may Roosevelt Management Co. inside the 2023 if you’re controlling the fall out out of a great cyberattack later last 12 months.

In hopes that in case i show the experience, some body here could highly recommend an alternative for people, while we defintely however need good HELOC alternative. We’re not in the a great scenario out-of a credit fitness direction. Why we got to possess denial are that the risk rating did not fulfill criteria while in underwriting. TIA for your views.

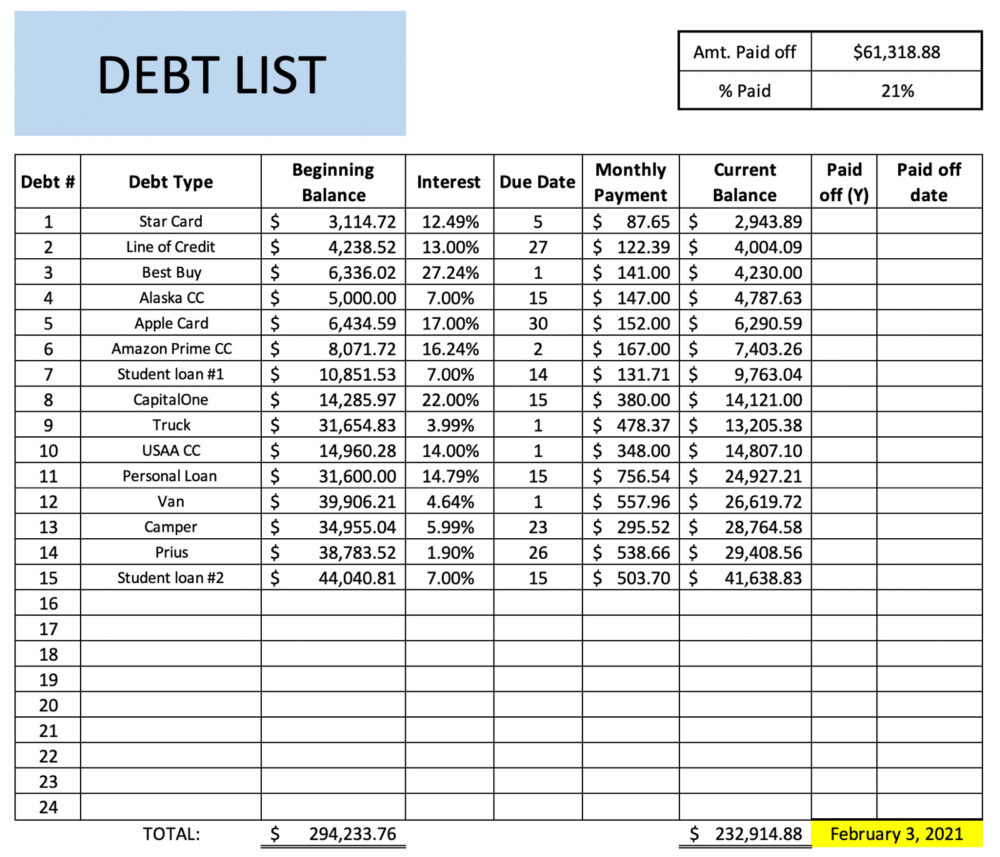

We have been carrying a high number of car loan obligations, and more than if it’s this new credit lines exposed in the most common latest one year. A total of $3200 when you look at the money month-to-month, which have financing total regarding $195k.

For any fintech that uses AVM, i have a potential situation. All of our home estimated worthy of to your Redfin is actually $657k and you can Zillow $365k. The fresh new Zillow guesstimate is without question out of, to have atleast the past five years, considering the county mistakenly filing a secure parcel purchase of $50k under our target a few years ago. I have made an effort to get Zillow to correct they predicated on the newest appraissals, but no luck. Undecided in the event it things.