Credit score: It is best to look after a credit history away from 750 and over pay day loans in Salmon Brook for a good chance of one’s app being approved. Banking institutions & Loan providers rely on credit history before giving your house mortgage to test the trustworthiness and you may mortgage installment record.

Decreased Income: Banks and you can loan providers consider the monthly income to see if you are able to pay off their equated monthly instalments (EMIs) or otherwise not. It will always be better to take a mortgage having EMI only forty% of your month-to-month income. Make sure that you see all the criteria before applying for home financing.

A lot of applications to have mortgage within the a short span away from time: For folks who sign up for a home loan out-of more lenders, it means financial institutions and you will loan providers that you’re in short supply of credit and want to utilize to many source so you can fill the new gap. Loan providers believe you would not manage to pay your own financing, which leads to rejection of your house loan application.

Established mortgage portfolio: Already, for those who have numerous finance to repay, after that your lender may think that you won’t find a way to look at a unique EMI on your current income, that lead to your residence financing getting rejected.

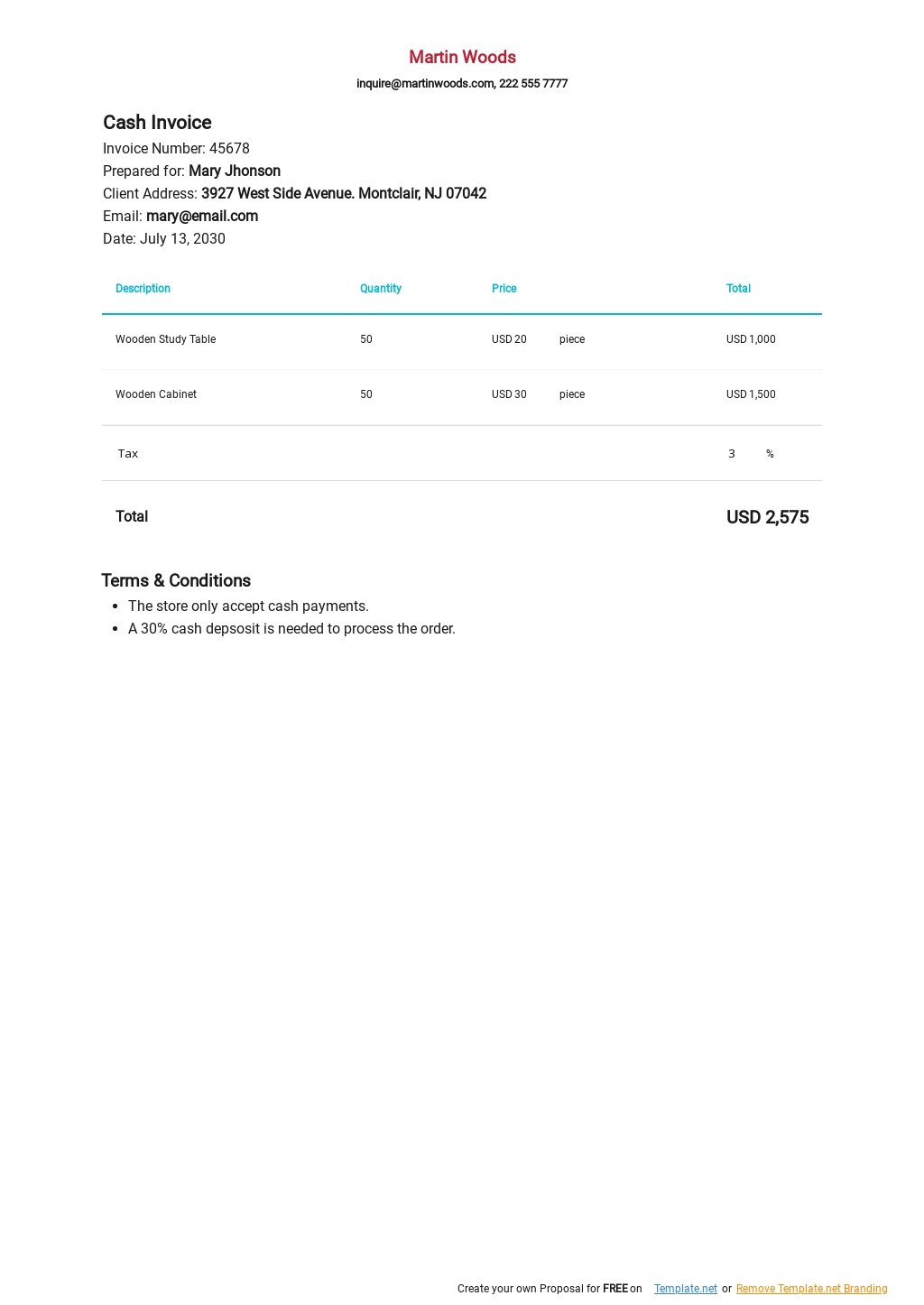

Bank Statements to possess 90 days Income Sneak to possess 90 days Address Proof: Aadhar Credit / Passport Name Research: Aadhar credit / Passport / Dish Cards

Fixed Home loan pricing: The rate of interest applicable on the Mortgage is restricted regarding the name off payment out of Mortgage.

Therefore, it’s best to try to get home financing once you has actually reduced a number of the other fund to reduce your EMI load

Floating Home loan rates: The rate of interest appropriate to your Mortgage change that have improvement in the Bank’s Base rate. Read More