If you are planning to apply for a home loan from inside the the long run, you are probably monitoring your credit rating closely. You are paying attention to the score ahead off financial and you may credit card comments. Maybe you are record they thru a budgeting software eg Perfect otherwise NerdWallet. While you are smart, youre plus monitoring your borrowing, and personal title utilize, for the totally free regulators websites such as for example annualcreditreport. However, possibly the really diligent regarding financing candidates tends to be shocked whenever their credit rating is actually taken getting a mortgage and you may it is lower than questioned. Here’s the advice for being able to access your correct credit history and you may knowing how to optimize it to your advantage.

Why Credit scores Are very different

One of the primary misunderstandings individuals have is because they provides you to credit score. In fact, you may have several credit ratings. Envision every larger investigation one to borrowing organizations gain access to. Up coming thought the way it is within the credit industry’s economic focus to incorporate several sizes regarding the study: much more records equals additional money. Each lending industry would rather have a look at additional data also. Hence, for people who got out a car or truck and you can home loan to your exact same time (which, in addition, we really do not recommend) might probably log off which have two different fico scores.

Understand Your own Classic FICO Score To own A mortgage

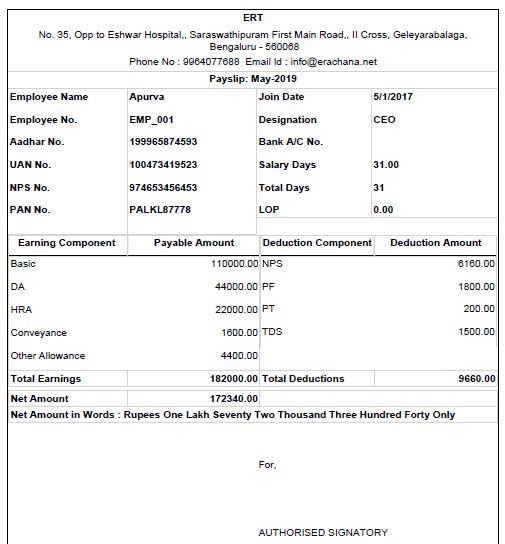

In the mortgage community i make use of the Vintage FICO Score, which includes a standard report from Experian, Equifax and Transunion. To get into your own accurate Antique FICO credit rating head to myfico. You could purchase a single-day step three-bureau statement otherwise register for an enrollment plan. When you found your own statement, understand that which have:

- You to candidate, lenders use the middle rating.

- Several candidates, loan providers uses the lowest of your own middle ratings.

Difficult Against Flaccid Borrowing from the bank Remove

Once you pull their borrowing, its sensed a mellow pull. You may also initiate as much mellow brings as you wish and will not apply to their borrowing from the bank.

Whenever a loan provider brings their borrowing having a beneficial pre approval it is a challenging eliminate. Difficult draws (otherwise questions) was listed on your credit history having two years. Yet not, they are utilised to choose an excellent FICO score for just 12 days. Ergo, several difficult credit inquiries inside one year or faster may affect your score to 5 issues for every remove. New effect tend to be more pronounced for folks having a primary credit score otherwise men and women deemed to be high credit dangers.

What you need to Find out about Credit rating TIERING

Your credit score will establish your loan’s recognition, cost and you may value. You’ll find eleven credit tiers with an excellent 19-pt rating pass on ranging from for every single level. In these tiers, whether you are at the reduced otherwise deluxe, the brand new cost of the loan is actually consistent. When you find yourself toward cusp of one of those levels, you are able to work on an authorized credit specialist so you’re able to alter your score and therefore your own cost. Pricing generally enhances as your credit rating increases.

Those with a 620 score otherwise straight down dont typically qualify for home financing. You really need to companion which have an official borrowing specialist in the event the your credit rating are less than 620.

At the time of , this new loan-peak cost improvements (LLPAs) takes impact one to imagine traditional credit rating and you may loan-to-really worth (LTV) percentages plus the newest Debt so you’re able to Earnings (DTI) or other points when choosing cost.

Please get in touch with Cori Pugsley in the Way Home loans https://elitecashadvance.com/payday-loans-wa/ when you have questions about your credit rating otherwise would like a recommendation getting an authorized borrowing from the bank counselor.