Most brokerage firms provide online buying and selling facilities for his or her What Is a Self Clearing Broker Dealer prospects by offering easy and hassle-free platforms ranging from web sites to cell purposes. Online buying and selling has gained widespread popularity in India and has induced broader investor participation within the stock markets with a number of advantages of buying and selling. Stockbrokers play an necessary role in the financial markets by making it easier for clients to trade securities. On behalf of that, they earn commissions or fees for his or her companies. Beyond executing trades, stockbrokers also conduct research and supply evaluation to information clients in making informed funding choices.

Sebi’s New Guidelines On Inventory Market Transaction Costs: A Have A Look At How Broking Firms Make Money

HDFC SKY is a SEBI-registered broker and your securities are held with a reputed depository participant, ensuring a secure and secure investment setting. In right now’s digital age, managing investments requires a platform that’s as user-friendly as it’s chopping edge! Enter HDFC SKY, an all-in-one solution offered by HDFC securities. This progressive platform caters to each seasoned buyers and novices, aiming to reinforce your funding journey.

What Are The Documents Required To Open An Online Trading Account?

Therefore, earlier than selecting a discount dealer, you must ask your self whether or not you want one or not. One of them is called “discount brokers.” These are these brokers who execute your transactions and cost low fees. As their companies are available at a major low cost, they are known as low cost brokers.

- These providers contain securities buying and selling, investment recommendation, retirement planning, administration of investment portfolio, taxes on capital gains, and so forth.

- Both of them may seem like the identical, but the line that separates an advisor and an agent/broker is explained for you as a bonus.

- To clear the confusion, this text will show you the insider view from the mutual fund firms and likewise the pros and cons of the mutual fund common and direct plans.

How Can A Monetary Planner Assist You In Recovering Your Financial Losses As A End Result Of Economic Crises Or Market Crashes?

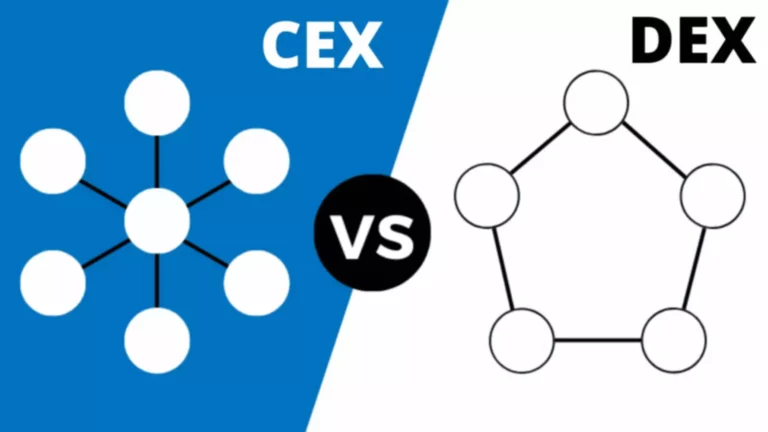

The framework of interoperability consists of a peer-to-peer link and participant hyperlink that may be established across the CCPs (Clearing Corporations). In a peer-to-peer connection, a CCP maintains special preparations with one other CCP and is not subject to the normal participant (membership) guidelines. Risk management between the CCPs relies on a bilaterally approved framework, which is completely different from that applied to a traditional market participant and ensures coverage of inter-CCP exposures.

Role Of Clearing And Forwarding Agents In Exports

Entry-level brokers typically start with a modest salary but have the potential to extend their earnings by way of commissions and performance-based incentives. These charges ensure that brokers have the necessary sources to function successfully and adjust to the monetary laws, thereby defending investor pursuits and maintaining market stability. To become a broker in the Indian stock market, one must meet numerous deposit and net worth requirements across completely different market segments and types of memberships. These structured requirements guarantee brokers have enough monetary stability to handle trading operations successfully.

Can Online Buying And Selling Platforms Provide Funding Advice?

A stockbroker in India can earn between ₹3 lakh to ₹7 lakh each year initially. With expertise and a strong shopper base, the salary can improve considerably, reaching as a lot as ₹15 lakh or more yearly for senior brokers. A firm should have no much less than ₹30,000 in paid-up capital to register as a stockbroker in India. Here are some ideas you’ll be able to comply with to run and grow your brokerage firm successfully.

Bonds Vs Stocks: A Beginner’s Guide

The DP in charge of your account may be identified by the eight-digit DP ID… Investors should keep in mind elements like fees, user-friendliness, available funding potentialities, customer support, and regulatory compliance when selecting a web-based trading app. The accrued advantages of interoperability will be higher if a lot of exchange-traded products can be found for buying and selling, clearing and settlement under the interoperable framework. Currently, NSE has virtually 100% market share in equity futures and options, and 95% of money trades also occur on NSE.

What Are The Fundamentals Of Clearing?

To turn into a stockbroker in India, you want to pay an software processing payment of ₹10,000 (excluding taxes) and one-time admission fees of ₹5,00,000 for all divisions besides ‘only debt’. We will talk about how to purchase mutual funds and not using a broker/agent now. When you rent a mutual fund agent, he can take the duty to transfer the ownership to the nominee as per the will of the investor.

Our Goods & Services Tax course includes tutorial movies, guides and expert assistance that will assist you in mastering Goods and Services Tax. Clear can even allow you to in getting your small business registered for Goods & Services Tax Law. A devoted vendor to plan, focus on and strategize your investments. An instance of Front-running is when a broker buys shares in a inventory earlier than placing a big shopper purchase order, aiming to profit from the worth improve ensuing from the client’s substantial order. It creates an uneven taking part in field, the place market movements are influenced not by genuine supply and demand dynamics, however by manipulative practices.

Brokerage refers again to the course of of buying and promoting securities similar to shares, bonds, and mutual funds. A brokerage firm acts as an middleman between consumers and sellers in monetary markets. The firm facilitates inventory trades by providing a platform for buyers to purchase and sell securities whereas charging a fee charge for his or her services. With the assistance of brokerage firms, investors can entry a wide range of funding alternatives and make knowledgeable decisions about their financial future. They assist traders purchase and promote stocks, bonds, and different securities by providing entry to market data, trade execution platforms, and funding recommendation.

However, you would possibly have the ability to conduct targeted direct mail, online advertising, and e mail advertising using advertising materials which have obtained compliance approval. If you need extra personalized advice, you can get your free appointment for 30-minute complimentary monetary plan consultation right here. Also, concede to examine if the stuff you do & the time you spend to do them your self is really price sufficient for the profit you get by means of reducing bills or rising returns. You can walk into the department office of the mutual fund home and fill up the applying forms your self.

Interoperability opened new opportunities for CCPs, with BSE being a listed stock, traders are speaking about its clearing arm ICCL revenue development in the near future. Discount brokers provide many engaging features, like low expenses, a fast account opening process, cell apps, etc. However, they might not go well with the requirements of all types of investors.

Read more about https://www.xcritical.in/ here.