People have a tendency to consider if they can be discontinue the FHA home loan insurance premium. Cancellation try feasible under specific problems that depend to your when the mortgage is started as well as how highest the initial down-payment are.

For people who took your mortgage from , you could potentially clean out Mortgage Premium (MIP) when your loan-to-well worth proportion dips lower than 78%. For those who secure a loan article-, MIP removing is present shortly after a 11-seasons months, but as long as your own down-payment was at least 10%.

To possess money taken up until the year 2000, there isn’t any prospect of canceling MIP. It’s important to ensure that mortgage payments are made timely in order to support the financing inside a good position to help you qualify for cancellation.

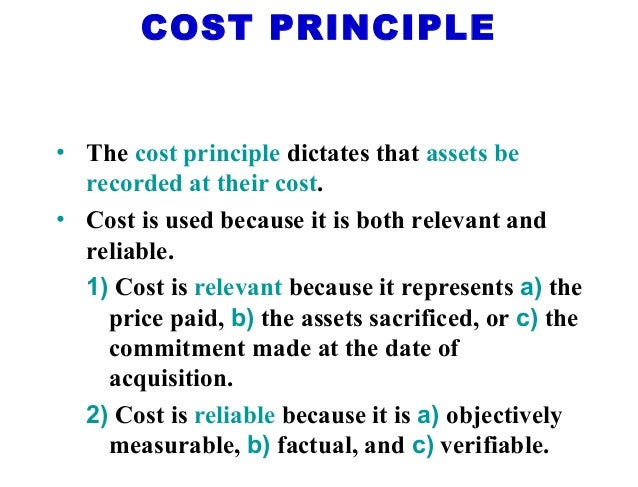

Cutting or entirely deleting FHA home loan premium can cause notable reduces in your monthly payment. If you have built up at least 20% security of your home, that active method is refinancing off an enthusiastic FHA financing in order to a conventional loan. Read More